Banking strength and stability since 1864. And they continue proudly today.

A word from our chairman and CEO

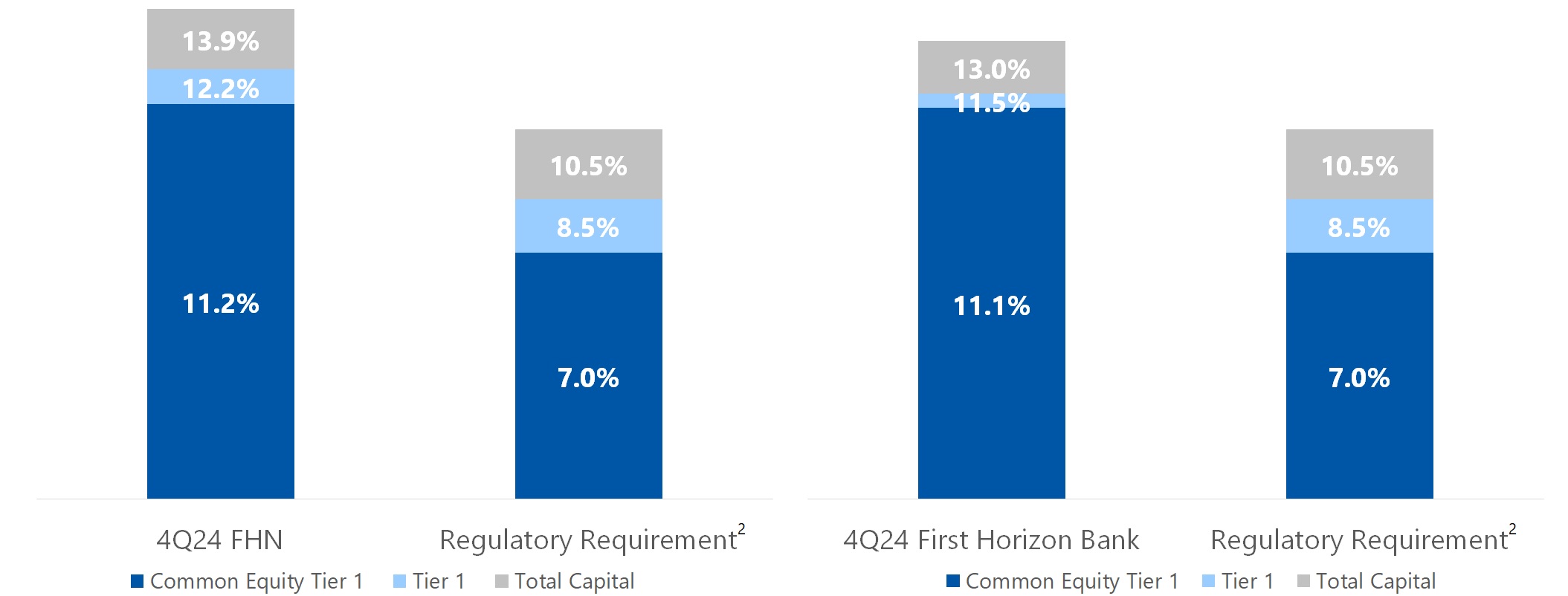

“Our strong capital position, disciplined credit quality, and well-diversified, stable funding mix enable our business to navigate challenging industry dynamics and consistently serve our clients and communities in a seamless fashion. We have the people, platform, and ambition to continue on our growth journey.”

– Chairman, President and CEO Bryan Jordan

A history of strength

Since 1864, First Horizon has continuously served clients through changing economic conditions and financial environments.

Both our liquidity position as well as our capital reserves remain strong.

Diversified business model

Our business model is well diversified by lines of business, geographically and by asset type, making our bank more resilient to market disruption.

By the numbers

As of 12/31/2024

BANKING CENTERS

416

BANKING CENTER STATES

12

ASSOCIATES

~7,200

ASSETS1

$82.2B

LOANS1

$62.6B

DEPOSITS1

$65.6B

The company holds a strong capital position