While we are not in the business of recommending collectibles as a long term investment strategy, here are some anecdotes we thought you might find interesting.

Two collectible markets that have piqued my interest are fine wines and classic cars. I have some personal experience in the former and serious voyeuristic interest in the second.

My initial collegiate studies in oenology did not focus on fine wine, as you might imagine. However, when my first daughter was born in 1982, I thought it would be fun to buy her birth vintage and lay it down in anticipation of celebrating with it at her wedding reception. Everything I read suggested first growth Bordeaux as the way to go. In 1985 when the 1982 Mouton Rothschild was released, I bought.

Several years later, facing a personal liquidity crisis (no pun intended), I sold the wine. Much to my pleasant surprise, the wine had skyrocketed in value and I booked what can only be described as a windfall profit. As with stocks, it is important not to confuse brains with a bull market!

That said, fine wines have become the subject of serious investment analysis. In 2005, Mahesh Kumar wrote “Wine Investment for Portfolio diversification” with the subtitle “How Collecting Fine Wines Can Yield Greater Returns Than Stocks and Bonds.”

If you are interested in tracking the prices of fine wines, look up the website hosted by Liv-Ex. They have created an index that tracks both narrow and broad indexes of fine wines around the world.

Cars are normally thought of as transportation, consumption expenditures and depreciating assets. However, some cars become classics and hold their values relatively well. Some have even held up well relative to inflation.

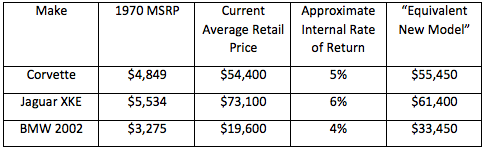

I went back and looked at some of the cars I was drooling over in 1970. Using the NADA (National Auto Dealers Association) website, I was able to get data on the manufacturers’ suggested retail prices (MSRP) as well as estimates of current market values. Here is what I found:

Please understand that these numbers are estimates, averages and otherwise not generally scientific data prone to precise analysis. But I do believe that they are directionally correct and serve to illustrate a point or two.

First and foremost, cool cars hold their value, more or less, relative to inflation. Since 1970, the Consumer Price Index has averaged about 4.1% according to data published by Bloomberg. All three of the above examples were able to do about that or better (we won’t talk about the cost of maintaining or insuring them).

Second, in some cases the classic is worth as much, if not more than the currently available “equivalents”. That’s called aging well!

In a world where there is a very distinct line between investment and consumption, it’s fun to find enjoyable activities that can keep up with inflation. As we stated at the outset, we are not in the business of recommending collectibles as investments. They have highly idiosyncratic risks, including high bid/ask spreads, transaction costs, storage and insurance expenses. In addition, it can be difficult to find a willing buyer at a fair price when the time comes to sell.

That all said, the psychic satisfaction and non-financial returns may be more than adequate compensation, particularly if you view these purchases as consumption expenditures.